TENDER OFFER

ALTANA Group intends to acquire all shares of Von Roll Holding AG through its subsidiary Elantas GmbH through a public tender offer for all outstanding shares of Von Roll Holding AG at a price of CHF 0.86 per share in cash. Von Roll Holding AG and Elantas GmbH have entered into a transaction agreement for this purpose.

The fairness opinion and the report of the Board of Directors can be found at https://transaktion.elantas.de.

Further Information can be found on the Website of Elantas GmbH:

https://voranmeldung.elantas.de

OUR FUTURE IS ELECTRIC

On the path to an emission-free future, many areas in the industry and in our daily life are being electrified.

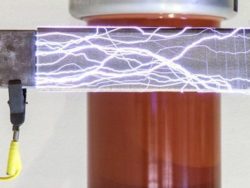

For decades, Von Roll has been the world’s leading specialist in electrical insulation systems. Our products are used in almost all electrical applications. They are essential for maximum performance, efficiency, and durability of electric motors, generators, batteries and power electronics.

New growth opportunities for our products are driven by the rapid growth of e‑mobility and renewable energy generation. Our particular strengths derive from our in-house developed high-performance tapes, resins and composites — combined with our vast experience in high-voltage applications.

This puts us in a position to be the leading supplier of fully integrated solutions from a single source. Von Roll Group operates at 14 locations worldwide and supplies customers in over 80 countries.

Annual results 2022

- 0Net sales (Mio.)

- 0EBIT (Mio.)

- 0EBIT margin

- 0Equity ratio

Facts & Figures

in MCHF | 1HY2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 20171 | 20161 |

|---|---|---|---|---|---|---|---|---|

Order intake | 119,4 | 242,1 | 234,8 | 197,0 | 297,0 | 335,9 | 336,1 | 326,9 |

Net sales | 122,6 | 227,7 | 218,6 | 212,2 | 291,6 | 321,4 | 332,4 | 319,2 |

EBIT | 11,8 | 14,8 | 21,9 | -16,6 | 9,8 | 2,5 | 4,5 | -17,3 |

Cash flow from operating activities | 3,9 | 24,0 | 0,2 | 6,8 | 12,6 | 18,6 | 5,3 | -10,5 |

Capital expenditures | 5,4 | 11,2 | 5,9 | 7,1 | 5,4 | 7,8 | 9,3 | 27,7 |

Equity | 212,7 | 206,0 | 199,9 | 167,9 | 199,0 | 198,6 | 107,2 | 97,0 |

Equity ratio (%) | 79,5 | 78,8 | 75.9 | 74.5 | 71.9 | 63.9 | 28.0 | 26.0 |

Number of employees (FTE) | 946 | 912 | 911 | 973 | 1,203 | 1,264 | 1,536 | 1,703 |

1Since 2019, the consolidated financial statements have been prepared in accordance with Swiss GAAP FER. The 2018 figures have been adjusted accordingly. The years 2017 and 2016 are presented according to IFRS.

in CHF | 2022 | 2021 | 2020 | 2019 | 2018 | 20171 | 20161 |

|---|---|---|---|---|---|---|---|

EBIT2 | 0.04 | 0.06 | -0.05 | 0.03 | 0.01 | 0.02 | -0.10 |

Operating cash flow3 | 0.07 | 0.00 | 0.02 | 0.04 | 0.09 | 0.03 | -0.06 |

Equity4 | 0.59 | 0.57 | 0.48 | 0.57 | 0.99 | 0.55 | 0.54 |

Number of issued shares | 357,433,804 | 356,674,804 | 356,558,804 | 356,558,804 | 356,544,804 | 201,768,555 | 201,445,555 |

Share price (high/low) | 1.24/0.56 | 1.32/0.71 | 0.94/0.49 | 1.38/0.81 | 1.49/0.98 | 1.74/0.56 | 1.00/0.51 |

Share price (end of period) | 0.86 | 1.08 | 0.80 | 0.87 | 1.32 | 1.40 | 0.62 |

Market capitalization (in MCHF) | 307.4 | 381.64 | 285.2 | 311.6 | 470.6 | 282.5 | 124.9 |

1Since 2019, the consolidated financial statements have been prepared in accordance with Swiss GAAP FER. The 2018 figures have been adjusted accordingly. The years 2017 and 2016 are presented according to IFRS.

2EBIT/weighted average number of issued shares

3Cash flow from operating activities/weighted average number of issued shares

4Consolidated equity/weighted average number of issued shares.

Beneficial Owners: Shareholder group consisting of Susanne Klatten (Munich, Germany), Von Roll Holding AG (Breitenbach, Switzerland), 346,063,342 shares, 96.82%.

Remarks: With the first closing of the public offer on 6 November 2023, 28,746,339 shares were transferred to ELANTAS GmbH (“Offeror”) (“Closing”). Upon Closing, the members of the management of Von Roll Holding AG, Ch. Hennerkes and A. Lust, leave the Group after the 6,000,000 shares held by them were tendered into the Offer during the Offer Period. The Transaction Agreement between the Offeror and Von Roll Holding AG with regard to a public offer for the publicly held shares of Von Roll Holding AG remains in place.

This might als interest you

High-Voltage Institute

Leading competence center for high voltage insulation.

Von Roll Innovation Lab

Activities from our research.

Wind power on a grand scale

Sustainable offshore energy for future generations.

NxtGen Composites

New composites for the airplanes of tomorrow.